Introduction to Infrared Protocol

Exploring the intricate realm of digital finance, the Infrared Protocol emerges as a guiding light for optimizing crypto liquidity. Characterized by its pioneering approach, this protocol tackles the inherent complexities of liquidity management, aiming to bridge the gap left by conventional systems. At its foundation, the Infrared Protocol is an innovative framework promoting the effortless exchange of digital assets, thereby enhancing market fluidity.

The core of crypto liquidity resides in its ability to enable swift transactions without causing significant price fluctuations—a critical feature for both individual and institutional investors. By curating a collection of inventive tools and leveraging keen market insights, the Infrared Protocol empowers users to navigate and exploit market dynamics with increased accuracy and effectiveness. Essentially, this protocol surpasses traditional strategies by merging advanced technology with a deep understanding of market operations, causing a fundamental change in the digital asset sector.

For those interested in understanding more about how liquidity is ensured, proof of liquidity systems can offer valuable insights.

As we journey through this expanding landscape, the Infrared Protocol not only enhances the liquidity network but also integrates seamlessly with current infrastructures, thus strengthening the reliability of the crypto environment. Through this blend of innovation and enhanced liquidity, it paves the way for a more durable and inclusive digital economy. If you're looking to engage with these advancements, you can explore our innovative financial products or learn more about our services.

Understanding Crypto Liquidity

Cryptocurrency liquidity pertains to the facility with which an asset can be converted into cash without substantially impacting its market value. This characteristic is of paramount importance in the digital currency world, as it directly affects trading efficiency, price consistency, and market engagement. Robust liquidity in a market usually results in narrower bid-ask differentials, enabling traders to fulfill orders swiftly without major price variances.

The importance of liquidity in the cryptocurrency domain cannot be exaggerated. A fluid market is more resistant to price distortion, offering a dependable environment for traders and investors. When liquidity is abundant, it acts as a stabilizing factor, helping to temper extreme price fluctuations that mark more erratic and less fluid markets. This equilibrium engenders trust among participants ranging from individual investors to institutional giants.

Moreover, liquidity affects trading efficiency, which is vital for anyone immersed in the crypto realm. Effective markets permit the smooth fulfillment of trades, minimizing slippage - the gap between anticipated and actual transaction prices. This effectiveness draws not only traders looking to optimize returns but also market creators who prosper by narrowing differentials and maximizing turnover.

Additionally, highly liquid cryptocurrencies tend to draw greater market involvement. The ease of entry and exit supports a wider range of trading strategies and attracts a diverse group of market players. Liquidity thus serves as the essential energy of trading ecosystems, fostering a setting rich with prospects and vibrancy.

Grasping the subtleties of crypto liquidity is crucial for anyone navigating the complexities of the cryptocurrency market. For deeper understanding of its dynamics, the notion of proof of liquidity systems can be an advantageous area of investigation. To further enhance your understanding and capabilities, consider exploring our services and explore our innovative financial products.

Leveraging Advanced Insights with Infrared

Infrared Protocol is at the cutting edge of a transformative approach to user engagement, particularly within the ever-evolving digital financial ecosystem. By employing sophisticated insights, it seeks to delve into the subtle behaviors and preferences of its users, paving the way for more precise and effective engagement methodologies. This commitment to harnessing intricate data analytics allows Infrared Protocol to shape its strategies meticulously, ensuring that interactions resonate deeply with individual users on a meaningful level.

Against the backdrop of a fiercely competitive digital finance arena, this approach steers not only towards enhanced user satisfaction but also bolsters Infrared Protocol's status as a pioneer of innovation. Through thorough analysis of behavioral patterns, the Protocol anticipates user needs and customizes financial offerings with a remarkable degree of personalization and contextual relevance, which could be explored further in our innovative financial products. The integration of such insights into actionable strategies embodies a paradigm shift, cultivating a more immersive and impactful user experience.

As digital finance increasingly intertwines with everyday life, Infrared Protocol's employment of advanced user insights sets a compelling precedent for future innovations within this dynamic sector. For more information on how we leverage proof of liquidity systems and other services, please visit our services page.

Effective Tools for User Engagement

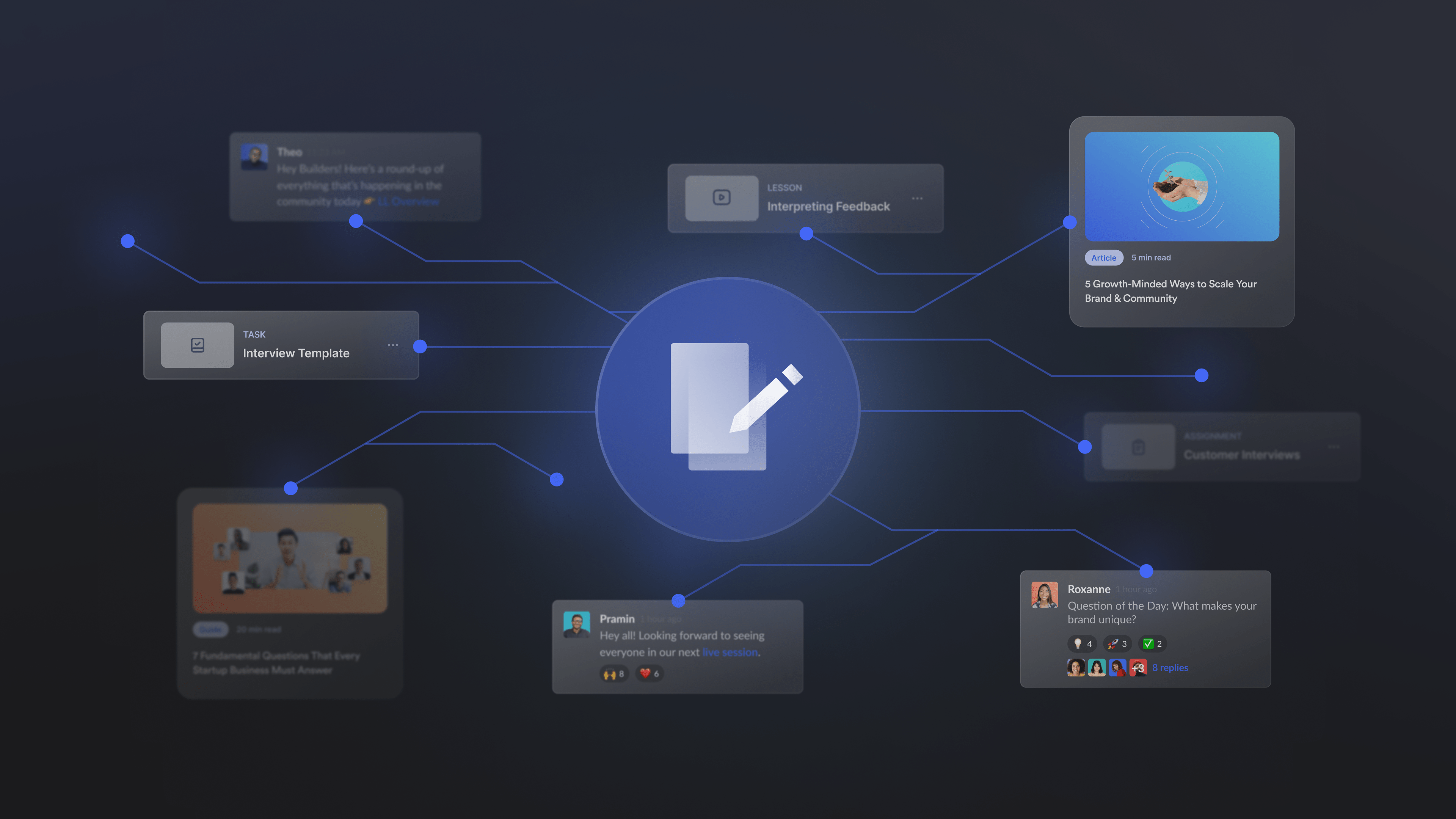

Infrared Protocol’s collection of resources boasts a wealth of features carefully crafted to boost participant involvement and create more vibrant exchanges with financial offerings. At the heart of this toolkit is a user-friendly analytics interface that captures, processes, and displays a myriad of participant data, providing unmatched insights into behavioral trends. By utilizing this information, enterprises can customize singular user experiences that resonate profoundly with personal preferences, thereby nurturing a lasting bond with their customers.

Additionally, Infrared Protocol's multi-channel communication network facilitates seamless dialogues across various mediums, empowering participants to engage without obstacles or interruptions. This fluid interaction not only maintains consistency in messaging but also strengthens brand credibility and allegiance. Another standout feature is the gamification component, which cleverly integrates elements of fun into financial exchanges, turning routine tasks into captivating activities that boost participant interest and gratification.

The platform also empowers participants through its state-of-the-art personalization algorithms, which curate content and recommendations in real-time, based on previous interactions and predictive analysis. This highly tailored approach ensures that users are seen and appreciated, resulting in a richer engagement with the platform's provisions.

With these cutting-edge resources at their command, enterprises can surpass traditional interaction models, forming a mutually beneficial connection with their audience that not only enhances participant engagement but also propels product affection to unparalleled levels. For a thorough understanding of these transformative services, explore our services in detail. Additionally, learn more about our proof of liquidity systems and how they function within the platform. To explore more about our innovations, explore our innovative financial products.

Innovative Financial Products and Services

In the ever-evolving realm of cryptocurrencies, Infrared Protocol stands at the cutting edge, offering pioneering financial products and services crafted to address the unpredictable demands of this rapidly expanding market. Through an amalgamation of advanced technology and in-depth market understanding, they have developed a range of offerings that not only cater to current investor requirements but also foresee future trends. Their dedication to innovation is apparent in their provision of algorithmic trading solutions that enhance transaction speed and precision, fulfilling the needs of high-frequency traders. Furthermore, their diversified portfolio includes yield-generating products, which utilize decentralized finance (DeFi) protocols, such as proof of liquidity systems, to unlock new income streams for investors, combining high returns with robust risk management frameworks.

Infrared Protocol's financial instruments embody a fusion of adaptability and safety, designed to suit the varied risk preferences and investment timelines of today’s crypto enthusiasts. A notable example is their tokenized asset offerings, which democratize access to traditionally illiquid markets, allowing a wider investor base to engage in lucrative ventures previously reserved for institutional players. Moreover, their customized insurance solutions reduce exposure to the volatile shifts inherent in crypto markets, providing a safety net that boosts investment confidence. By continually advancing the frontiers, Infrared Protocol not only addresses the pressing needs of contemporary investors but also propels the crypto industry toward new horizons of opportunity. To explore our innovative financial products and understand our services better, visit our website.